Biding its time beneath our feet is enough heat to power the entire state of California. But that’s nothing. According to a 2008 estimate from the US Geological Survey, there may be enough sub-surface energy in the West alone to meet roughly 70 percent of the nation’s electricity needs. Other projections have placed that figure far higher, exceeding the sum of all energy consumed in the United States.

Lofty promises also have been made about solar and wind, but there’s a vital difference: Geothermal is reliable. Unlike solar and wind power, which depend on the weather and thus require backup storage or natural gas plants to be effective, geothermal can single-handedly displace fossil fuels.

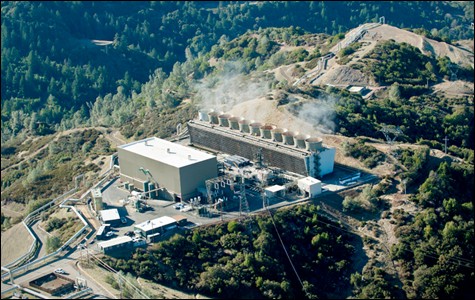

Eighteen geothermal power plants are distributed across 45 square miles at The Geysers. Credits: Courtesy Calpine Corp.

Tungsten carbide drill bits used at The Geysers can cost up to $5,000 each. Credits: Nate Seltenrich

How enhanced geothermal systems work. Credits: Courtesy US Department of Energy

Representing the industry’s next wave, Calpine’s enhanced geothermal systems project has tapped into heat stored in rock more than 11,000 feet beneath the surface. Credits: Nate Seltenrich

Development of geothermal energy also produces minimal environmental impacts, further distinguishing it from large-scale solar, which can harm desert species, and wind turbines, which kill birds and bats. New closed-loop geothermal plants operate with essentially zero water use and no emissions but steam, and the technology is far safer than nuclear fission. Renewable, carbon-free geothermal is about as free of trade-offs as energy gets, and as a resource is nearly inexhaustible.

It can also be one of the cheapest sources of energy available. A January 2010 report by the California Energy Commission comparing costs of electricity generation for new plants in the state — including capital expenses, financing, insurance, taxes, fuel, and operations and maintenance — identified geothermal as among the most affordable: cheaper than solar, natural gas, and biomass, similar to coal, and beaten only by wind and hydropower.

In short, geothermal could be the answer to all of our energy needs — if only we could get to it.

Although the geothermal industry in the United States is nearly fifty years old, cumulative energy production remains relatively small: a total of 3,200 megawatts, equivalent to three nuclear reactors or six coal plants. That figure continues to grow, slowly — 450 megawatts of new power have come online in the last seven years, including 91 megawatts from five projects since the beginning of 2011. By comparison, the US solar industry, which is approximately the same age, added 500 megawatts in the first three months of 2012 alone.

Despite its obvious benefits, geothermal energy faces a suite of external and internal challenges. These include the up-front expense of locating and harnessing geothermal resources, the lack of effective government incentives, and the recent decline in natural gas prices. All three are stifling new exploration and development today, and threatening geothermal’s ability to fulfill its promise tomorrow.

Vast quantities of potential geothermal power are currently available in known locations using existing technologies, just waiting to be tapped: according to the US Geological Survey, as much as 16,000 megawatts, or 16 gigawatts. That’s the low-hanging fruit. Another 8 to 73 gigawatts may exist in undiscovered traditional systems.

New technologies and drilling techniques being developed now, however, will offer access to an exponentially larger amount of geothermal power. Estimates range from the Department of Energy’s low-end 100 gigawatts to the upper range of the US Geological Survey’s projections at an incredible 725 gigawatts, not including anything east of Colorado, which has yet to be adequately mapped. The United States’ total existing energy production capacity is around 1,100 gigawatts.

Geothermal’s eye-popping prospects have caught the attention of the federal government and the high-tech sector. In 2009, the Obama administration earmarked $341 million in stimulus funds to support geothermal development. Although those funds are not yet exhausted, the energy department’s Geothermal Technologies Program has requested that its annual financial allotment be nearly doubled next year. The Lawrence Berkeley National Lab, National Renewable Energy Laboratory, and United States Geological Survey are all also engaged in geothermal energy research. And in 2008, Google’s philanthropic arm placed a bet of its own, to the tune of more than $10 million.

Nonetheless, the geothermal industry is only cautiously optimistic, forecasting moderate growth in the coming years but loath to make any promises. As one official with the Department of Energy’s geothermal program summed up the industry’s short-term outlook, “Our goal is that when people discuss renewables like wind and solar, they mention geothermal in the same sentence.”

The rocky trajectory of the geothermal industry in the United States, from its hopeful beginnings in the early 1960s through decades of ups and downs to its expansive yet elusive potential today, can be traced through a huge geothermal field right here in Northern California. Straddling Sonoma and Lake counties in a mountainous, largely undeveloped area south of Clear Lake, the 45-square-mile geothermal field known as The Geysers houses the world’s largest complex of geothermal plants. It currently produces around 900 megawatts of power, nearly a fifth of California’s clean-energy portfolio.

Fifteen of the field’s eighteen plants belong to Houston power company Calpine, which was founded in San Jose in 1984 and has a 23-year history at The Geysers. As the company grapples with mistakes in The Geysers’ past, looks toward near-term expansion, and works to develop the next generation of geothermal energy, it mirrors the path of the industry as a whole. Its success in the coming years will help determine if large-scale geothermal power will become a panacea or simply another science-fiction pipe dream.

The first thing any visitor to The Geysers notices is its sheer remoteness. The drive from Calpine’s visitor center in nearby Middletown to some of the more distant drilling platforms can be thirty miles or more. Newcomers sometimes arrive expecting to pull up to a single massive power plant with huge volumes of steam billowing into the blue sky, said Danielle Seperas, Calpine’s manager of Government and Community Affairs. They’re often disappointed.

The Geysers more resemble the Altamont Pass wind farm than a monolithic solar field in the Mojave Desert. Wells and small power plants are distributed over a vast area seemingly at random, often located miles apart and connected by rough dirt roads, looking like industrial blemishes on the natural environment. Rocky outcroppings, scrublands, and forests of manzanita, madrone, oak, and pine are dispersed across the steep terrain, seemingly as naturally as the day they were discovered — if you can overlook the network of power lines; bare, winding roads; and eighty miles of above-ground steam pipelines.

Within the next few years, Calpine plans to add a few more specks to the landscape, albeit in the busier southeastern portion of The Geysers (the majority of a ten-square-mile section in the northern part of the property has yet to be developed). The company received approval in November to build a pair of 49-megawatt plants, but is holding off on breaking ground until it can secure long-term power-purchase agreements for both.

Meanwhile, a Reno-based company, Ram Power Corporation, is expected to complete a new 25-megawatt plant at The Geysers by the end of next year, which will be the first plant built there since 1989. Together, the new projects will nudge the field’s total power production above 1,000 megawatts.

That’s a far cry, however, from the more than 2,000 megawatts it was once capable of generating. Instead, current production is limited to less than half that, with most plants running at 50 percent capacity.

The reason why is a cautionary tale for geothermal developers everywhere. Beginning in the early 1980s, before Calpine bought a stake in its first plant, The Geysers experienced something of a land rush. Developers scrambled to snatch up drilling sites, build power plants, and tap into The Geysers’ massive underground steam reservoir, heated by a shallow field of magma.

By the end of the decade, the boom had gone bust. Geothermal plants function by drawing steam from the earth and running it through a turbine to produce electricity. However, steam flow at The Geysers had dramatically decreased, and investigations revealed that the underground reservoir was not recharging itself with surface water as quickly as believed.

At the same time, plant operators were returning only about 20 percent of extracted water to the reservoir, with the remainder evaporating away. In other words, the earth was still generating heat, but the medium needed to convert it to power was missing, reducing the field’s production and threatening its long-term viability. “They were drawing so much fluid out of the reservoir that the pressure started dropping like a stone,” said Bill Powers, a San Diego-based energy expert who advocates for clean power.

The answer, naturally, was more water. In 1997 came a 29-mile, $45 million pipeline from the Lake County Sanitation District, delivering 8 million gallons of highly treated wastewater every day (a volume that has since declined). And in 2003, a second pipeline followed, this one 40 miles long and delivering approximately 14 million gallons per day from the City of Santa Rosa. The water sources, which are used to replenish The Geysers’ naturally occurring underground reservoir, remain essential to operations. Without them, the field could suffer a second, even more severe blow.

But the water may not be available forever. During a recent tour of The Geysers, Calpine Director of Engineering Tim Conant said that while the 25-year contract with Lake County is likely to be extended when it expires in 2022, the Santa Rosa water, guaranteed through 2038, might be less of a sure thing. As the city and surrounding area grows, and as uses for treated and recycled water increase, there’s a chance that Santa Rosa may eventually want to keep some or all of its water.

Either way, Powers has concerns about the long-term prospects for power production at The Geysers. “It’s basically on a form of life support,” he said. “The Geysers couldn’t be further from sustainable. … It’s somewhat of a stunner to hear how short-sighted it is.” He has a similar critique for California’s second-largest geothermal complex, located on the Salton Sea in Southern California, where he suggests a similar crash could be looming.

His solution for both, which he outlines in a March report on the future of clean-energy production in the region called Bay Area Smart Energy 2020, is to retrofit geothermal power plants with a modern cooling system that will reduce water losses, gradually improve reservoir pressure deep inside the earth, and offer the opportunity to extract more steam from the ground — up to 300 megawatts more at The Geysers, Powers estimates. The significant up-front cost would be repaid over time by increased energy production.

But Calpine doesn’t have any such plans, said Seperas. Instead, the company is adjusting to the new reality by reducing turbine sizes to increase efficiency at today’s flow levels. And with its water sources fixed for at least the next 26 years, Calpine is more intent on developing the next wave of geothermal power plants, known as enhanced geothermal systems, or EGS. In 2008, the company began a partnership with the US Department of Energy to build a $12 million EGS demonstration project at The Geysers. If successful, it could lead geothermal’s transition from stepchild to savior.

Enhanced geothermal systems differ from traditional systems in one major way: They don’t require an existing underground reservoir of steam or water. Unlike traditional plants, which are relegated to continental plate boundaries and other areas of naturally occurring geothermal activity, enhanced systems can work in all fifty states.

First, developers drill into areas of hot, dry rock located more than a mile beneath the surface. They inject cold water under low pressure to expand existing fractures in the rock, then drill a second well at the other end of the system. Water is pumped through the injection well into the new fractures, where the hot rock converts it to steam. It’s then extracted through the production well, and finally fed into a power plant. In many cases, the same water can be reinjected after cooling — dramatically reducing water use and eliminating the sort of issues faced at The Geysers.

As with hydraulic fracturing in the natural gas industry, the EGS fracturing process poses a risk of inducing small earthquakes. However, seismic monitoring by the Lawrence Berkeley National Laboratory at various drill sites has shown the risk to be negligible, largely because water is injected at low pressure — it essentially seeps into the earth under gravity, relying on the temperature differential to create cracks. EGS fracturing also differs from natural gas fracking in that it uses clean water, free of chemicals that could contaminate drinking supplies.

The Obama administration appears convinced of geothermal’s promise. Along with $341 million in stimulus funds for the development of geothermal technologies, the Energy Department allots a separate annual amount for geothermal energy, just as it does for solar, wind, biomass, and hydrogen. The geothermal program has received about $37 million in each of the last two years, but that figure is expected to nearly double to $65 million in 2013. The Department of Energy’s solar program, by comparison — which admittedly dwarfed geothermal at $289 million this year — may grow by only 7 percent, while the agency’s investment in wind technology should remain flat and its hydroelectric program could shrink from $59 million to $20 million.

With stimulus funds still available and next year’s budget likely to grow, it’s an exciting time for geothermal energy research and development, said Doug Hollett, program manager for the Energy Department’s Geothermal Technologies Program. “The sweet spot of that is really 2012 and 2013. That’s when everything is happening.”

About two-thirds of next year’s federal budget for geothermal research and development will be dedicated to EGS. That’s above and beyond the $60 million already committed to a total of six full-scale EGS experiments throughout the West, of which The Geysers’ project is just one. “The full potential of the EGS program, attaining those really exciting numbers, is really predicated on the R&D sector,” Hollett said. “The better job we do, the faster it’ll happen.”

But the United States isn’t the only country racing to perfect enhanced geothermal systems. France, Germany, England, and Australia have also launched projects — though roadblocks have so far outnumbered breakthroughs. In at least one respect, The Geysers are again out front. “This is the first commercially successful EGS project in the world,” said Calpine Senior Geologist Mark Walters. “There is no EGS project in the world that produces enough fluid to be economic. … So we believe we’ve already met the Department of Energy’s goal.”

Granted, the project is commercially successful only in theory. Calpine won’t technically make any money off the new well — which should be able to produce 5 megawatts — until a utility agrees to buy the power at a price that will provide a return on its investment. Nor will the company proceed with a dedicated power plant nearby and begin to extend its reach into the undeveloped northern part of The Geysers — where EGS technology could help pull hundreds of megawatts out of the ground — until a power purchase agreement is inked. Yet no utility has been forthcoming.

The reason? Competition from natural gas, which provides nearly a third of the nation’s power. Prices have plummeted due to the glut of gas being produced from shale rock by fracking across the country, a process implicated in a string of environmental and human-health problems. Natural gas prices hit a ten-year low this spring, dipping below coal for the first time in history. Today the fuel is nearly 50 percent cheaper than it was a year ago.

The result has been a cooling effect within the entire geothermal industry. The same thing occurred during the natural gas boom of the 1980s, which ended a period of rapid growth and caused government investment in geothermal to virtually disappear.

As Calpine waits to successfully conclude its EGS experiment, other demonstration projects supported by the Department of Energy trail closely behind. These include two Nevada projects costing $6.8 million and $7.5 million, one in Idaho ($10.6 million), and another in Oregon ($43.7 million). Each is at a different stage, but significant findings are due across the board within the next year or so — except at the final project, a $24.8 million Alaska well that’s temporarily on hold due to funding and technical issues.

Beyond Calpine’s experiment, the one being developed by Seattle company AltaRock at the Newberry Volcano in central Oregon is furthest along — and potentially the most impressive. It’s the only one of the six to be built from scratch, rather than at an existing geothermal field or well. If it works, it will help prove that EGS is the key to unlocking a vast cache of hot, dry rock around the world. Come October, when AltaRock performs a flow test to determine the volume of steam it can pull from the well, it’ll know for sure.

“We’re really hopeful that this is going to be successful,” said Susan Petty, founder, president, and chief technology officer of AltaRock. “The only renewable energy source that can replace coal power would be geothermal, and the only way you can scale it big enough to do that is with EGS.”

But Petty knows there’s more to it than simply generating enough steam. As Calpine’s trials have demonstrated, the trick is doing it at a price that the market can bear. While Petty estimates that AltaRock’s Newberry well could produce energy at 16 cents per kilowatt-hour, her target is below 10 cents. The Department of Energy’s goal for EGS nationwide is even lower, said Lauren Boyd, the department’s EGS technology development manager: 6 cents, a value designed to compete with natural gas over the long term. “We’ve been able to demonstrate that we can actually do this,” she said. “The next step is trying to do this at a bigger scale and at a cost we can afford.”

Imagine, for a moment, erasing the US geothermal industry’s entire fifty-year history. What you end up with is a vaunted new energy technology on the cusp of a breakout. Its 3,200 megawatts of current production are paltry, after all, compared with its long-term potential.

But for geothermal to truly happen, costs will have to come down at both traditional reservoirs and enhanced systems. As the California Energy Commission’s 2010 cost survey showed, it’s possible. But those calculations were based primarily on new plants at known or existing geothermal fields; most of the cost and risk currently involved in exploration isn’t accounted for. Developers can spend more than $10 million drilling a single well, even an unsuccessful one.

To reduce risk and improve return on investment, drilling will have to become not only cheaper, but also less of a gamble. And that will require better maps and remote-sensing capabilities allowing developers to see what’s underground before they drill. “People are still finding geothermal reservoirs while drilling for something else,” said Karl Gawell of the Geothermal Industry Association. “We’re still trying to find out what’s there.” Even with enhanced geothermal systems, developers need to know the depth, temperature, and permeability of underground heat stores.

Plenty of solutions are underway. Google, which has invested more than $1 billion in renewable energy and clean technologies, announced a $10.25 million EGS program in 2008 that included nearly $500,000 for a detailed mapping project. (Dan Reicher, Director of Climate and Energy Initiatives for Google.org, called enhanced geothermal systems at the time “the ‘killer app’ of the energy world.”) Google’s partner, Texas’ Southern Methodist University, used the money to develop a detailed online map that breaks down the nation’s geothermal resource by state and places its ultimate value at nearly 3,000 gigawatts, four times higher than any previous estimate.

Other mapping projects are being undertaken by both the National Renewable Energy Lab and the United States Geological Survey, whose current maps cover only the western half of the country. The Department of Energy also is investing in remote-sensing technologies that will permit developers to view rock formations miles into the earth’s crust.

Yet price alone doesn’t tell the entire story of geothermal’s economics. After all, throughout the solar explosion of the last few years, solar technology has remained one of the most expensive forms of energy available. Prices of photovoltaics have plunged, but they’re still roughly three times those of coal and natural gas. The difference has been government incentives, said Bill Glassley and Elise Brown of the California Geothermal Energy Collaborative, based at UC Davis.

The same production tax credits and cash grants from the federal government that jump-started the solar and wind industries in 2009 and 2010 had a far smaller impact on geothermal because they do little to defray its up-front costs. “Roughly half of the total project costs for a geothermal plant are in the exploration and drilling phase, which makes financing difficult and suggests that perhaps a different set of incentives would make sense,” Glassley said. The incentives would also need to be maintained over the long-term, due to geothermal’s extended development time line. The current batch expires at the end of 2013, not nearly enough time to get any new projects off the ground — effectively rendering them useless.

With mapping, remote sensing, and effective incentives in place, the industry would be poised to take off. New technologies and equipment would grow more reliable and efficient, further driving down costs. It’s a clear path to success, but one that many onlookers will believe only when they see it. “You’re talking about a technology that is still being developed,” said Dave Hamilton, Director for Clean Energy in the Sierra Club’s Beyond Coal Campaign. “We regard it with a lot of potential, but there’s a lot of unanswered questions.”

That reticence is shared by many within the industry. “Most people think that EGS can be oversold,” Gawell said. “They have a reaction to people who are very outspoken about it. Most people in the geothermal business will tell you that this is not an easy business to be in.

“Some companies feel that it gets blown out of proportion,” he continued. “Some companies are sweating to get their 50-megawatt power plants up and built, and here you’ve got a professor talking about tens of thousands of megawatts.”

But you can hardly blame the cheerleaders. Science has proven the resource exists, and begun to quantify its incredible potential. The US government has shown more than a passing interest in the technology, and private developers have reached important early milestones. California Energy Commissioner Karen Douglas even remarked in January that geothermal could well become California’s “bread and butter” baseload power source, AOL Energy reported, by the time its two nuclear plants are decommissioned around 2050.

In the coming years, more and more traditional geothermal plants will go online throughout the West. A recent report from the Geothermal Energy Association identifies 130 projects in various stages of development across twelve states. Thirty-one are in California, not including Calpine’s expansion plans at The Geysers, which had not yet been approved. The company also is in the early stages of developing two plants near Mount Shasta.

Calpine, one of North America’s leading power producers with 75 natural gas plants scattered across the country — including in Pittsburg, Antioch, and San Jose, and one under construction in Hayward — relishes its role as the world’s largest generator of geothermal energy. However, even a $17.5 billion corporation with industry-leading expertise derived from decades in the business can’t bend geothermal’s future to its will. “We hit the ball,” said Calpine engineer Tim Conant, “and now we’re just waiting on the market.”

Editor’s Note: A previous version of this story mistakenly attributed the quotation beginning “Roughly half of the total project costs …” to Steve Ponder. It was in fact Bill Glassley of the California Geothermal Energy Collaborative who said that. We also misspelled the name of Calpine engineer Tim Conant.